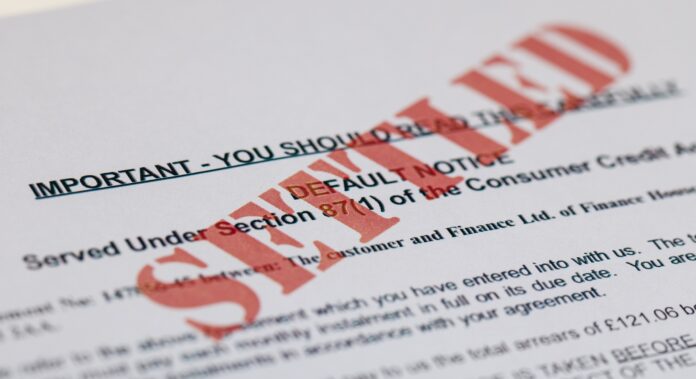

Picture going to your mailbox to get your mail and finding a large envelope with paperwork for a debt lawsuit inside. You feel stunned, afraid, and overpowered. What do you do now? The majority of consumers would rather avoid dealing with debt-collecting mailings, calls, or legal action. However, you might need to be made aware of how common they are. Some agencies can use language that has the potential to instill fear. It can seem tempting to avoid lawsuits, but that is not the best course of action for you.

Ensure that you are aware of your rights first. It can, however, make a significant impact if you know what occurs when you receive a summons for debt and what actions you can take to contest a debt lawsuit lawfully. So, hiring an attorney to represent you and defend against the case is vital. If you want a debt collector harassment attorney to protect your legal rights, you can find here.

Below are the ways and steps you should take when facing a lawsuit.

Quickly Answer The Lawsuit

When handling a lawsuit, sometimes the borrowers get scared and frequently choose not to reply and attempt to dismiss the debt collection litigation. However, it is not a good idea and can turn against you. If you disregard the court order, it might result in a default court judgment against you.

This means that you have already lost the litigation. This is the process of wage garnishment. Additionally, they can withdraw funds immediately from your bank account to cover their expenses and charge additional charges like interest, court costs, or legal fees. You must reply promptly as quickly as possible.

After you get a notice from the court, you cannot respond over the phone. You must submit a legal response. Also, when responding to the notice, ensure that you do not mention any responsibility for the debt. Let the debt collector prove that you have to pay their debt. You must respond to the lawsuit’s question within the given time frame. All this can be a hassle, but a debt collector harassment attorney ensures everything is in place.

Contest the Company’s Suitability in Law

It is possible to dispute the plaintiff’s eligibility to bring the action as a response to debt litigation. Debt collectors are frequently independent companies that the original creditor hires after you default. If you believe the debt is fraudulent, you can contest the action. You should submit a judicial response to the lawsuit you are facing if you disagree with the allegations.

Following then, you will have the chance to oppose the lawsuit’s claims or request that the court dismiss it entirely. It is legally necessary for the party suing you to provide evidence that it has the authority to do so.

If you don’t reply, the court will assume you are admitting guilt for the debt because judges won’t look up this fact on their own. The judge will, however, likely support your request if it is made at a hearing or in writing. The plaintiff must provide the credit agreement you signed when taking the debt.

All documents must include proof of the chain of custody or, to put it another way, be correct and have the original creditor’s signature on it. Plaintiffs unable to present this proof may not have the legal right to file the claim. As a result, courts frequently throw out debt lawsuits.

Take Advantage Of the Burden Of Proof

When defending against a debt collection lawsuit, take advantage of the burden of proof.

Remember that the creditor is suing you, so they have to show the burden of proof; they have to prove that you owe them money. They are the ones who need to demonstrate that you owe them their total amount.

Make sure your creditor provides proof of the debt you owe. If it relates to a credit card debt, demand that they provide records that date back to when you created the account. Once more, if the entity suing you purchased the debt, they might not be able to provide sufficient proof of what you owe.

Hire An Debt Harassment Attorney

Hearing a third party’s point of view helps put things into reasonable perspective. Spending more money on legal fees frequently seems like not a great decision when they already have a debt to pay.

However, speaking with a lawyer helps you with your case, and you better understand all of your options for fighting a debt collection case. A lot of the lawyers who provide this service also offer free consultations. You’ll be able to determine if any options are available to you, determining whether the advantages outweigh the cost of the legal fees—additionally, lawyers who think the creditor committed a crime to help you to win your case.

Try To Settle

Another option is to try and reach a deal with your creditor. After receiving the complaint, you can sign a Consent Judgment or request that the matter is dismissed if a creditor can come to an agreement. Also, even if both parties have reached an agreement, you must find out if you need to attend the hearing to inform them of your agreement. Otherwise, there are chances that your creditor might obtain a default judgment.

Determining Your Exemption

It depends on the amount of debt and the state you reside in. People with modest incomes and assets may not be subject to wage garnishment, making them “judgment proof,” depending on the state and the amount of debt. To ascertain whether you meet these requirements, speak with a counselor, attorney, or another specialist in your field.

Conclusion

Being sued can be difficult, and many are unsure where to begin. It’s necessary to reply directly or through counsel if your creditor brings a lawsuit against you. And remember that you have rights, too, even if you are in debt. So, it is always better to consult with your lawyer to have the best course of action.