In the fast-paced world of Fintech, where user engagement and retention are crucial for sustained success, app gamification has emerged as a game-changer. By incorporating game-like elements into financial applications, Fintech companies can create a highly immersive and rewarding experience for their customers. In this comprehensive guide, we will explore the concept of app gamification in Fintech and uncover the top six features that ensure high customer retention rates. Read more to discover how these innovative strategies can revolutionize your Fintech app and keep your users coming back for more.

Personalized User Profiles

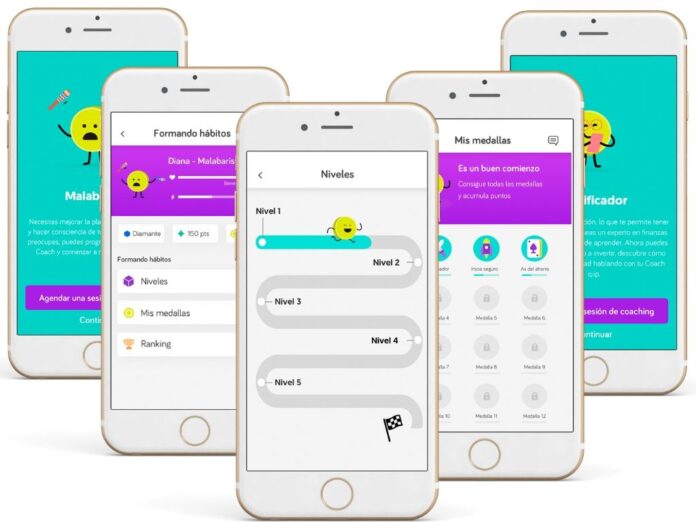

One of the key features of app gamification in Fintech is the ability to create personalized user profiles. By allowing customers to customize their profiles with avatars, badges, and other virtual elements, Fintech apps can provide a sense of ownership and identity to users. Personalized profiles foster a deeper emotional connection with the app, encouraging customers to return and engage frequently.

Interactive Financial Challenges

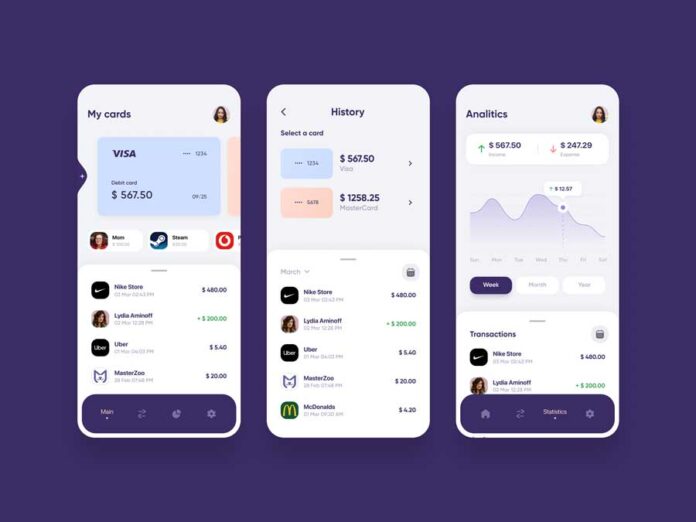

App gamification in Fintech goes beyond standard banking functionalities. It introduces interactive financial challenges that encourage users to set and achieve specific financial goals. These challenges may involve saving a certain amount of money, completing financial quizzes, or managing expenses within a budget. By completing challenges, users earn rewards and recognition, fostering a sense of accomplishment and progress.

Loyalty Points and Rewards

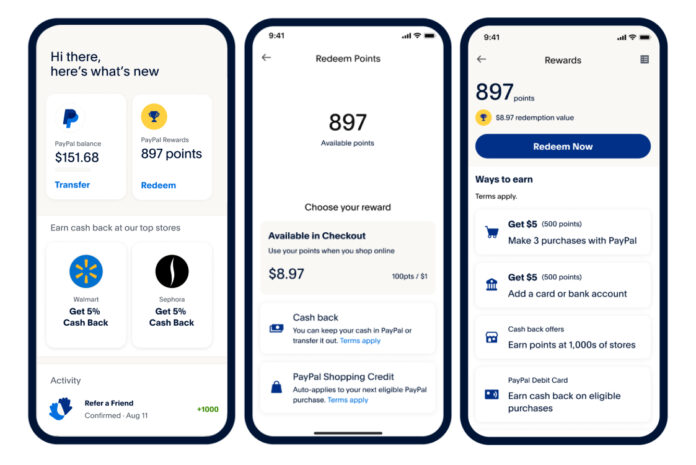

Loyalty points and rewards are powerful tools for driving customer retention in Fintech apps. By offering points for various interactions and transactions within the app, users are motivated to stay engaged and earn more rewards. Fintech companies can leverage these rewards to incentivize desired behaviors, such as using specific financial products or services, which ultimately increases customer loyalty.

Financial Education and Insights

App gamification in Fintech is not just about entertainment; it also serves as an educational platform. Fintech apps can offer financial insights, tips, and personalized recommendations to improve users’ financial literacy. By empowering customers with knowledge and guidance, Fintech companies can build trust and establish themselves as valuable partners in their financial journey.

Social Engagement and Community

Humans are social beings, and incorporating social elements into Fintech apps can significantly impact customer retention. App gamification allows users to connect with friends, family, or other app users, enabling them to share financial achievements, compete in challenges, and learn from each other’s experiences. Social engagement fosters a sense of belonging and accountability, encouraging users to remain active and loyal to the app.

Real-Time Progress Tracking

The element of progress tracking is at the heart of app gamification in Fintech. Users want to see tangible results and track their financial growth over time. By providing real-time updates on savings, investment returns, or debt reduction, Fintech apps keep users engaged and motivated to continue using the app to achieve their financial objectives.

In the dynamic landscape of Fintech, customer retention is a vital metric for success. App gamification has proven to be a powerful strategy to enhance customer engagement and loyalty. By integrating game-like features into their apps, Fintech companies can create a compelling and interactive experience for users, keeping them connected and committed to achieving their financial goals.

From personalized user profiles to interactive challenges and loyalty rewards, the top six features of app gamification in Fintech ensure a high level of customer retention. Moreover, providing financial education, fostering social engagement, and enabling real-time progress tracking further enhance the overall user experience.

As the Fintech industry continues to evolve, app gamification will play an increasingly significant role in driving customer retention and loyalty. By embracing these engaging features, Fintech companies can establish a competitive edge and build long-lasting relationships with their customers, ensuring sustainable growth and success in the ever-evolving world of finance.

As the Fintech industry continues to grow and evolve, app gamification is expected to become an integral part of customer retention strategies for financial institutions. The combination of innovative technology, personalized experiences, and interactive challenges has the potential to revolutionize the way customers interact with financial services.

In addition to increasing customer retention, app gamification can also lead to higher customer satisfaction and brand loyalty. When users find an app enjoyable and rewarding to use, they are more likely to recommend it to others, leading to organic growth and a positive brand reputation. Moreover, the data collected through gamified interactions can provide valuable insights into customer behavior and preferences, enabling Fintech companies to further enhance their offerings and tailor their services to meet the ever-changing needs of their clients.

However, as with any technology-driven approach, there are challenges to consider when implementing app gamification in the Fintech domain. Striking the right balance between fun and functionality is essential; excessive gamification can lead to a loss of focus on the core financial services, undermining the app’s purpose. Additionally, security and privacy concerns must be addressed rigorously to ensure that gamified interactions do not compromise sensitive financial data.

To successfully leverage app gamification, Fintech companies must invest in the right technology and partner with experienced developers who understand the intricacies of blending gaming elements with financial functionalities. A well-designed and thoughtfully executed app gamification strategy can yield significant returns in terms of customer retention and engagement.

In conclusion

app gamification has emerged as a compelling tool in the Fintech industry, revolutionizing the way financial services are delivered and experienced by customers. By harnessing the power of interactive challenges, personalized experiences, and real-time progress tracking, Fintech companies can create an engaging and rewarding environment for users, leading to higher customer retention, loyalty, and satisfaction.

As the demand for digital financial solutions continues to grow, embracing app gamification can give Fintech companies a competitive edge and drive success in an increasingly dynamic and competitive market. By continuously evolving and innovating, Fintech companies can stay at the forefront of the industry, delighting their customers with immersive and rewarding experiences that keep them coming back for more. The future of banking and finance lies in the hands of those who can effectively integrate gaming elements into their services, transforming mundane financial interactions into delightful and memorable experiences for customers worldwide.