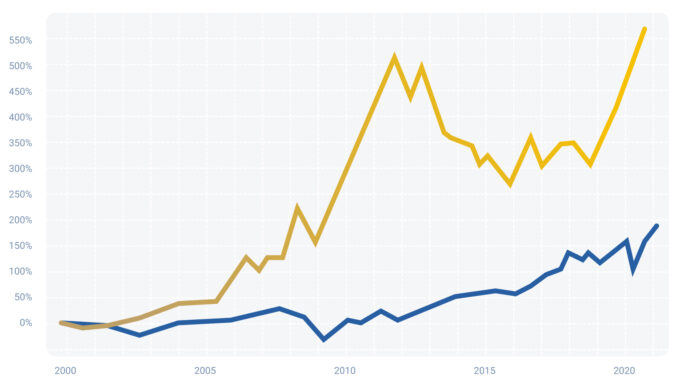

Investing in precious metals such as gold, platinum, silver and many more, is an excellent way to diversify your asset portfolio and hedge against inflation. However, reading expensive metal cost charts accurately is essential to make informed investment decisions. This article will discuss the critical elements of precious metal price charts and how to interpret them correctly.

Understanding the Chart Components:

Precious metal price graphs can look complicated at first glance, but they are easy to understand once you break them down into their components.

- Time Axis: The duration or time axis is the horizontal line on the chart that displays the chart’s time frame. It can range from minutes to decades, depending on the type of graph you’re looking at.

- Price Axis: The price axis is the vertical line on the chart that displays the current price of expensive metallic objects. It typically ranges from the lowest price to the highest price of the metal in a given time frame.

- Graph Type: Different graphs, such as line charts, bar charts, and candlestick charts. Each graph displays information differently, so choosing the type that suits your needs is essential.

Interpreting The Chart:

Interpreting a chart involves understanding various elements and using them to gain insights into the market. To expand on each aspect mentioned:

- Identifying the Trend: The trend indicates the general direction of price movement. It is crucial to observe the price over a specific period to determine the trend. An uptrend occurs when the price consistently rises, indicating a bullish market. Conversely, a downtrend signifies a bearish market when the price consistently decreases. If the price moves sideways within a specific range, it suggests a range-bound or consolidating market.

- Analysing the Volume: Volume refers to the number of shares or contracts traded within a given timeframe. High volume suggests increased market participation and often indicates greater interest in the precious metal. It can provide confirmation for price movements, indicating that the trend is strong and sustainable. Conversely, low volume suggests reduced market activity, which may lead to less reliable price movements.

- Using Indicators: Indicators are tools that provide additional information about the market’s direction and potential turning points. Moving averages, for example, calculate the average price over a specified period and help identify the overall trend. Short-term moving averages respond quickly to price changes, while long-term moving averages offer a more smoothed-out view. Oscillators, on the other hand, indicate overbought and oversold conditions, helping identify potential reversal points in the market. It’s important to use indicators in conjunction with other analysis techniques to obtain a comprehensive understanding of the market dynamics.

By considering the trend, volume, and indicators, traders and investors can make more informed decisions. However, it’s crucial to remember that no single chart or analysis technique guarantees accurate predictions of future price movements. The interpretation of charts should be accompanied by other forms of analysis, such as fundamental analysis and market sentiment, to gain a well-rounded perspective on the market.

Tips for Reading Precious Metal Price Charts:

- Choose the Right Chart Type: Different chart types display information differently, so choosing the chart type that suits your needs is essential. For example, if you’re looking for short-term trading opportunities, a candlestick chart may be more suitable than a line chart.

- Keep an Eye on the News: The news can significantly impact the precious metal market. Keep an eye on the news to stay informed about developments affecting the market’s direction.

- Use Multiple Time Frames: Looking at the precious metal cost chart in multiple time frames can give you a better understanding of the market’s direction. For example, if you’re a long-term investor, you can click here and look at the monthly and weekly charts to get a sense of the long-term trend while also analysing the daily and intraday charts for short-term trading opportunities.

Practice Patience and Discipline:

Trading precious metals requires patience and discipline. Don’t let emotions cloud your judgement; always stick to your trading plan. It’s essential to have a straightforward entry and exit strategy before making any trades.

- Emotional Control: Emotions such as fear and greed can cloud judgement and lead to impulsive decisions. It is important to stay calm and rational when analysing market movements and making trading decisions. By controlling emotions, traders can avoid hasty actions that may result in losses. Developing a mindset focused on long-term profitability rather than short-term gains is essential.

- Stick to Your Trading Plan: A trading plan outlines specific rules and strategies for entering and exiting trades. It should be based on thorough analysis and reflect your risk tolerance and financial goals. Once a trading plan is in place, it is crucial to stick to it and avoid deviating based on impulsive reactions to market fluctuations. Consistency in following the plan can help avoid erratic trading and improve overall performance.

- Entry and Exit Strategy: Having a clear and well-defined entry and exit strategy is vital. Determine the criteria for entering a trade, such as specific technical indicators or fundamental factors. Additionally, establish conditions for exiting a trade, including profit targets and stop-loss levels to limit potential losses. By predefining these parameters, traders can take emotions out of the equation and make objective decisions based on their trading plan.

- Risk Management: Effective risk management is integral to successful trading. Set a maximum risk per trade or a percentage of your trading capital that you are willing to risk. This helps protect against significant losses and ensures that no single trade can excessively impact your overall portfolio. Applying proper risk management techniques, such as position sizing and diversification, can help preserve capital and minimise potential risks.

- Continuous Learning: The world of trading is dynamic, and staying updated on market trends, economic indicators, and geopolitical events is crucial. Commit to continuous learning and stay informed about factors that can influence precious metal prices. This ongoing education can enhance your understanding of market dynamics and improve your decision-making process.

By practising patience and discipline, traders can approach the precious metals market with a clear mindset and systematic approach. This disciplined approach helps mitigate emotional biases, maintain consistency, and increase the chances of achieving long-term trading success.

Conclusion:

Reading precious metal price charts is crucial for anyone interested in investing in precious metals. Understanding the chart components, interpreting the chart, and using technical analysis tools such as indicators can provide valuable insights into the market’s direction. You can make informed investment decisions and maximise your returns by choosing the right chart type, keeping an eye on the news, using multiple time frames, and practising patience and discipline.